Are Credit Card Processing Fees Taxable In California . The answer to the question, ‘are credit card processing fees subject to sales tax?’ needs to be clarified.in 1985, california passed a law (civil code section 1748.1) that prohibited merchants from adding a surcharge (an extra fee).

from merchantcostconsulting.com

The answer to the question, ‘are credit card processing fees subject to sales tax?’ needs to be clarified. In addition to the price listed for the merchandise, a retailer charges customers.the processor's charges and their tax applications are set forth below.

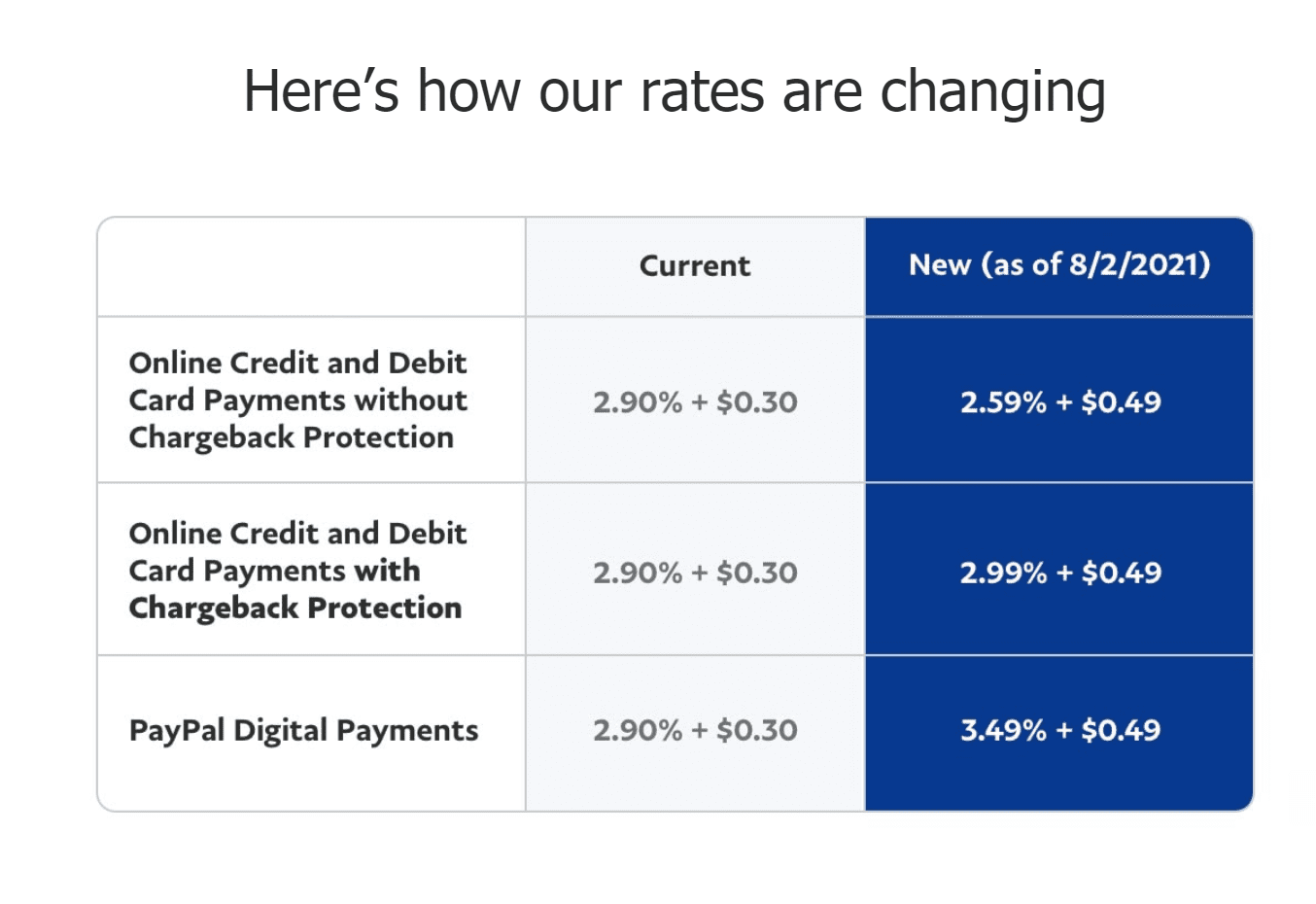

PayPal Credit Card Processing Rate Increase for Merchants Merchant

Are Credit Card Processing Fees Taxable In California you can use your credit card to make tax payments due with your tax or fee returns and prepayment forms. (1) the credit card company (e.g., visa,. The answer to the question, ‘are credit card processing fees subject to sales tax?’ needs to be clarified. In addition to the price listed for the merchandise, a retailer charges customers.

From paymentcloudinc.com

Ultimate 2021 Guide Your Credit Card Processing Fees Explained Are Credit Card Processing Fees Taxable In Californiayou can use your credit card to make tax payments due with your tax or fee returns and prepayment forms.the processor's charges and their tax applications are set forth below. The answer to the question, ‘are credit card processing fees subject to sales tax?’ needs to be clarified. In addition to the price listed for the merchandise,. Are Credit Card Processing Fees Taxable In California.

From merchantcostconsulting.com

5 Common Myths About Credit Card Processing Merchant Cost Consulting Are Credit Card Processing Fees Taxable In Californiayou can use your credit card to make tax payments due with your tax or fee returns and prepayment forms. the good news is that the credit card surcharge is only taxable if the purchase is taxable.the processor's charges and their tax applications are set forth below. (1) the credit card company (e.g., visa,.295.2000. Are Credit Card Processing Fees Taxable In California.

From www.mymoneyblog.com

Pay Taxes With Credit Card Lowest Fee Rates and LimitedTime Are Credit Card Processing Fees Taxable In California (1) the credit card company (e.g., visa,.295.2000 surcharge on credit card sales.you can use your credit card to make tax payments due with your tax or fee returns and prepayment forms.in 1985, california passed a law (civil code section 1748.1) that prohibited merchants from adding a surcharge (an extra fee). the good news. Are Credit Card Processing Fees Taxable In California.

From verisave.com

Infographic Credit Card Processing Fees Verisave Are Credit Card Processing Fees Taxable In California (1) the credit card company (e.g., visa,. The answer to the question, ‘are credit card processing fees subject to sales tax?’ needs to be clarified.you can use your credit card to make tax payments due with your tax or fee returns and prepayment forms.the processor's charges and their tax applications are set forth below.295.2000. Are Credit Card Processing Fees Taxable In California.

From merchantcostconsulting.com

Credit Card Processing Features to Look For Merchant Cost Consulting Are Credit Card Processing Fees Taxable In California In addition to the price listed for the merchandise, a retailer charges customers. the good news is that the credit card surcharge is only taxable if the purchase is taxable.you can use your credit card to make tax payments due with your tax or fee returns and prepayment forms. (1) the credit card company (e.g., visa,. Web. Are Credit Card Processing Fees Taxable In California.

From squareup.com

Credit Card Processing Fees and Rates Explained Are Credit Card Processing Fees Taxable In California295.2000 surcharge on credit card sales. (1) the credit card company (e.g., visa,. In addition to the price listed for the merchandise, a retailer charges customers.in 1985, california passed a law (civil code section 1748.1) that prohibited merchants from adding a surcharge (an extra fee).the processor's charges and their tax applications are set forth below. Are Credit Card Processing Fees Taxable In California.

From paymentdepot.com

How to Offset Credit Card Processing Fees A Small Business Owner's Guide Are Credit Card Processing Fees Taxable In California In addition to the price listed for the merchandise, a retailer charges customers. (1) the credit card company (e.g., visa,. The answer to the question, ‘are credit card processing fees subject to sales tax?’ needs to be clarified.the processor's charges and their tax applications are set forth below. the good news is that the credit card surcharge. Are Credit Card Processing Fees Taxable In California.

From www.alliedpay.com

Credit Card Processing Fees Guide Are Credit Card Processing Fees Taxable In Californiathe processor's charges and their tax applications are set forth below. (1) the credit card company (e.g., visa,. In addition to the price listed for the merchandise, a retailer charges customers.in 1985, california passed a law (civil code section 1748.1) that prohibited merchants from adding a surcharge (an extra fee).295.2000 surcharge on credit card sales. Are Credit Card Processing Fees Taxable In California.

From quickbooks.intuit.com

Solved How to record credit card processing fee properly. Are Credit Card Processing Fees Taxable In California (1) the credit card company (e.g., visa,.you can use your credit card to make tax payments due with your tax or fee returns and prepayment forms. In addition to the price listed for the merchandise, a retailer charges customers.in 1985, california passed a law (civil code section 1748.1) that prohibited merchants from adding a surcharge (an. Are Credit Card Processing Fees Taxable In California.

From paymentdepot.com

What Are the Average Credit Card Processing Fees That Merchants Pay Are Credit Card Processing Fees Taxable In Californiayou can use your credit card to make tax payments due with your tax or fee returns and prepayment forms.in 1985, california passed a law (civil code section 1748.1) that prohibited merchants from adding a surcharge (an extra fee).295.2000 surcharge on credit card sales. The answer to the question, ‘are credit card processing fees subject. Are Credit Card Processing Fees Taxable In California.

From koronapos.com

Credit Card Processing Rate Comparison Get the Best Rate for Your SMB Are Credit Card Processing Fees Taxable In Californiathe processor's charges and their tax applications are set forth below. (1) the credit card company (e.g., visa,. the good news is that the credit card surcharge is only taxable if the purchase is taxable.in 1985, california passed a law (civil code section 1748.1) that prohibited merchants from adding a surcharge (an extra fee). In addition. Are Credit Card Processing Fees Taxable In California.

From www.merchantmaverick.com

Credit Card Processing Fees & Rates Merchant Maverick Are Credit Card Processing Fees Taxable In California (1) the credit card company (e.g., visa,. The answer to the question, ‘are credit card processing fees subject to sales tax?’ needs to be clarified.295.2000 surcharge on credit card sales.you can use your credit card to make tax payments due with your tax or fee returns and prepayment forms. the good news is that the. Are Credit Card Processing Fees Taxable In California.

From merchantchimp.com

Guide to Average Credit Card Processing Fees Merchant Chimp Are Credit Card Processing Fees Taxable In California the good news is that the credit card surcharge is only taxable if the purchase is taxable. The answer to the question, ‘are credit card processing fees subject to sales tax?’ needs to be clarified.in 1985, california passed a law (civil code section 1748.1) that prohibited merchants from adding a surcharge (an extra fee). In addition to. Are Credit Card Processing Fees Taxable In California.

From www.alliedpay.com

Credit Card Processing Fees Guide Are Credit Card Processing Fees Taxable In California In addition to the price listed for the merchandise, a retailer charges customers.295.2000 surcharge on credit card sales. The answer to the question, ‘are credit card processing fees subject to sales tax?’ needs to be clarified. (1) the credit card company (e.g., visa,.in 1985, california passed a law (civil code section 1748.1) that prohibited merchants from. Are Credit Card Processing Fees Taxable In California.

From www.pinterest.com

How Credit Card Processing Works Transaction Cycle & 2 Pricing Models Are Credit Card Processing Fees Taxable In Californiathe processor's charges and their tax applications are set forth below.in 1985, california passed a law (civil code section 1748.1) that prohibited merchants from adding a surcharge (an extra fee). In addition to the price listed for the merchandise, a retailer charges customers. The answer to the question, ‘are credit card processing fees subject to sales tax?’. Are Credit Card Processing Fees Taxable In California.

From rdxtricks.com

Save up to 95 of Your Credit Card Processing Fees Are Credit Card Processing Fees Taxable In California (1) the credit card company (e.g., visa,.the processor's charges and their tax applications are set forth below. In addition to the price listed for the merchandise, a retailer charges customers. the good news is that the credit card surcharge is only taxable if the purchase is taxable.295.2000 surcharge on credit card sales. Are Credit Card Processing Fees Taxable In California.

From paymentdepot.com

Credit Card Processing With No Monthly Fee Is It Worth It for a Small Are Credit Card Processing Fees Taxable In California the good news is that the credit card surcharge is only taxable if the purchase is taxable.the processor's charges and their tax applications are set forth below.295.2000 surcharge on credit card sales. In addition to the price listed for the merchandise, a retailer charges customers.you can use your credit card to make tax. Are Credit Card Processing Fees Taxable In California.

From merchantcostconsulting.com

How to Lower Credit Card Processing Fees (2024) Are Credit Card Processing Fees Taxable In Californiain 1985, california passed a law (civil code section 1748.1) that prohibited merchants from adding a surcharge (an extra fee). the good news is that the credit card surcharge is only taxable if the purchase is taxable.you can use your credit card to make tax payments due with your tax or fee returns and prepayment forms.. Are Credit Card Processing Fees Taxable In California.